Online entertainment has evolved from static consumption toward interactive environments where participants influence economies as actively as designers script mechanics, creating new conditions for monetised play that mirror financial speculation.

Token-indexed reward engines turn game sessions into contractual exchanges of skill and compute, loosely comparable to retail order books.

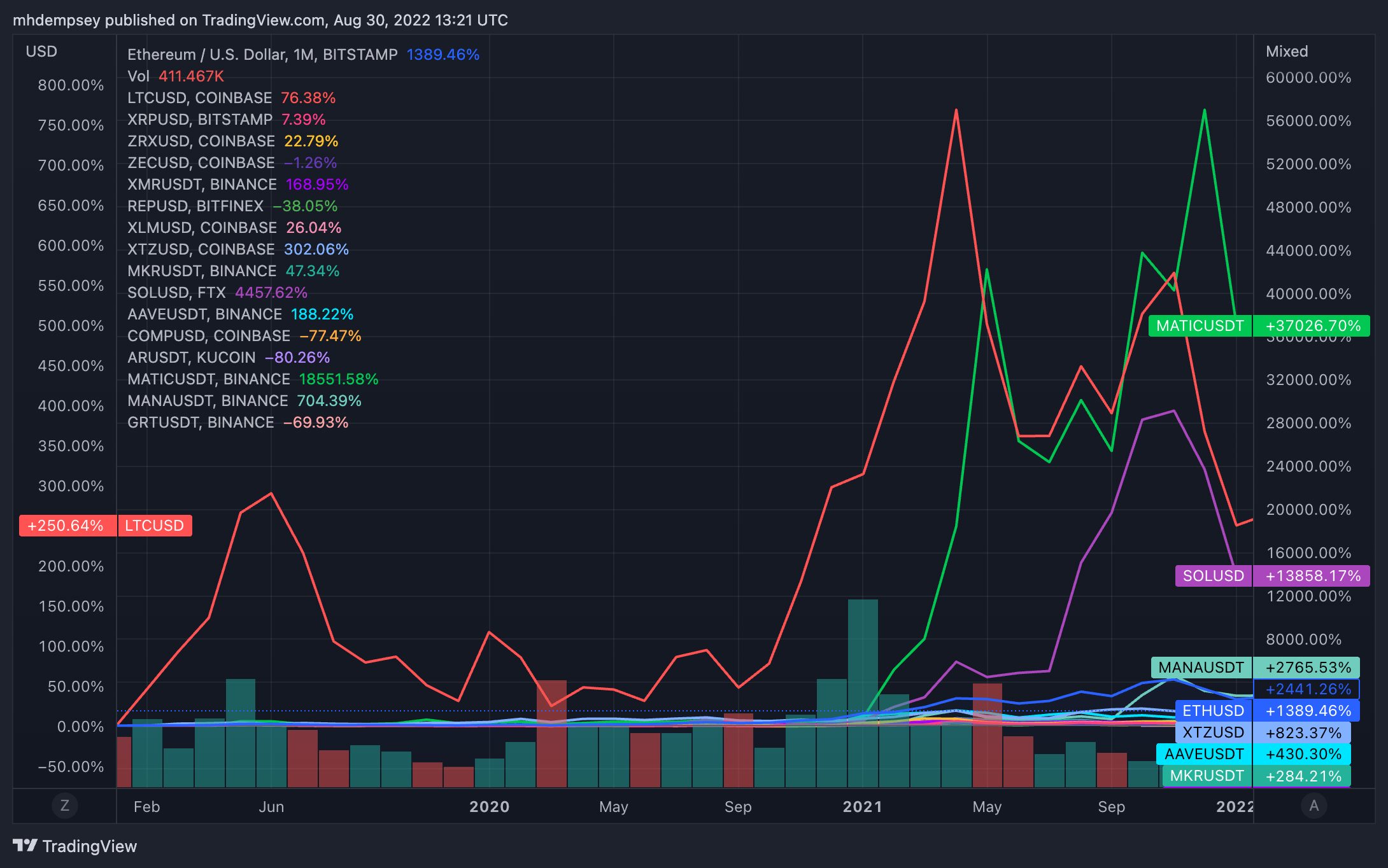

Consequently, analysts now track player behaviour with the same econometric vigilance applied to forex desks, because volatility in game-native assets can expose both systematic risk and opportunity.

Architecture Of Play-to-Earn

Play-to-earn frameworks assign deterministic or probabilistic payouts—often denominated in transferable tokens—to in-game milestones, thereby converting leisure sessions into measurable labour worthy of formal economic modelling.

Players recognise that they can get paid to play games, so engagement decisions increasingly pivot on projected yield curves rather than purely narrative appeal, injecting capital allocation logic into match-making queues.

Unlike subscription models that extract fixed fees regardless of user proficiency, this architecture rewards incremental mastery, so marginal improvements in reflex timing or strategic planning translate into escalating revenue streams.

Where traditional purchasing funnels ended at a title’s launch, ongoing issuance of earned tokens extends the revenue horizon, causing network value to depend on circulating supply governance and inflation throttles.

Smart-contract escrow layers mitigate counterparty default yet introduce attack surfaces that demand continual patch management and verification audits, because token custody errors can nullify months of aggregated play income.

When immersion depends on asset legitimacy, anti-cheat modules become de facto clearing houses, confirming that each score was achieved through authorised clients rather than automated macros or latency exploits.

Convergence With Digital Asset Trading Dynamics

Game tokens trade on secondary markets whose liquidity profile often mirrors small-cap coins, so spread width, slippage risk, and order depth constrain gamers’ ability to realise paper gains.

Price discovery therefore unfolds in Discord channels and algorithmic market-makers simultaneously, forging feedback loops where balance-patch rumours shift speculative positioning even before developers confirm patch notes.

Derivatives desks have begun quoting perpetual swaps on flagship gaming tokens, thereby importing funding-rate mechanics that incentivise hedging strategies uncommon in legacy entertainment but routine among crypto arbitrageurs.

Consequently, disciplined players back-test character builds like traders back-test moving averages, because both seek parameter sets that maximise risk-adjusted returns under stochastic payoff distributions.

Several exchanges advertise cost free trading periods for new gaming pairs, facilitating frictionless rotation among assets and encouraging volume spikes that bootstrap order books without immediate fee drag.

However, an absence of explicit exchange fees does not eliminate implicit costs such as wider bid-ask spreads during off-peak hours, so effective execution still demands latency-aware routing logic.

Primary Beneficiaries Of Incentivised Play Systems

Independent players who previously ranked mid-tier in competitive ladders now treat matches as micro-contracts, because even modest streaks can compound into stable weekly income when token price remains above cost-of-power thresholds.

Semi-professional streamers leverage verifiable on-chain earnings to negotiate sponsorship terms, substituting engagement metrics with audited wallet inflows that more accurately reflect community stickiness and potential brand lift.

Indie developers occupying niches between blockbuster franchises and casual mobile apps find performance-based economies attractive, since token liquidity can subsidise server bills without demanding invasive advertising integrations.

Esports organisers integrate reward tokens into prize structures, thereby aligning audience speculation with tournament turnout, because spectators who hold team-branded assets exhibit higher retention across seasonal breaks.

Regional internet cafes reposition themselves as low-capital trading floors where patrons access high-hashrate hardware for calibrated sessions, monetising idle rigs during local energy price troughs.

Research collectives studying computational sociology harvest anonymised telemetry from reward loops to refine behavioural models, as tokenised incentives produce finer-grained datasets than traditional achievement systems.

Operational Design Patterns And Emerging Market Signals

Supply-capped tokenomics remain popular, yet several studios pivot toward elastic issuance pegged to user-growth coefficients, adopting monetary policies reminiscent of algorithmic stablecoins rather than Bitcoin’s deterministic halving.

Cross-game interoperability protocols—built on layer-two rollups—allow assets to migrate between titles, distributing demand shocks and reducing correlation spikes that previously magnified single-game downturns.

Identity primitives anchored in zero-knowledge proofs enable multi-account compliance checks without exposing personal data, satisfying regulatory pressure while preserving pseudonymous culture central to competitive arenas.

Regulators evaluate whether reward tokens constitute transferable securities, so studios pre-emptively geofence distributions or embed play-time cliffs, mirroring how exchanges restrict leveraged products in certain jurisdictions.

Players seeking to earn extra hedge positional exposure by supplying liquidity to automated pools that pair game tokens with stable assets, thereby earning swap fees that cushion in-match performance variance.

Data pipelines that relay on-chain price feeds back into game engines open pathways for dynamic difficulty adjustment, ensuring payout ratios remain sustainable when token volatility deviates beyond predefined guardrails.

Closing Perspective: Sustainable Rewards In A Volatile Landscape

Performance-based gaming and retail trading share a behavioural substrate where participants pursue alpha through informed risk, yet the former overlays narrative and social context that modulate stress and time preference.

Designers capable of tuning reward schedules to mimic attractive Sharpe ratios without triggering runaway inflation will anchor long-term ecosystems that withstand speculative wash-out cycles.

Players who internalise portfolio discipline—spreading exposure across tokens, hardware depreciation, and fiat reserves—can mitigate downside while still capturing upside inherent in early adoption phases.

Market infrastructure that bridges controller inputs to price charts must maintain rigorous security posture, because memory corruption or oracle desynchronisation compromises both entertainment value and fiduciary trust.

If cultural legitimacy follows economic viability, then transparent governance, audited code, and predictable issuance schedules will become baseline expectations rather than optional marketing signals.

Under disciplined stewardship, the incentive to play for measurable reward can coexist with creative exploration, delivering a durable sector where skill, strategy, and prudent risk management jointly produce tangible financial outcomes.